A crypto trader, Vida, realized more than $1.5 million in gains after spotting an anomalous wall of buy orders on Binance for the little-known token BROCCOLI714 on New Year’s Day.

Vida, who shared detailed logs of the trade on social media platform X, said they initially treated the move as a likely hacked account or market-making bug.

Due to this, he revealed that he traded around the anomaly in two phases, first by exiting a large spot and futures exposure into the pump and later by shorting the token.

Binance has not publicly commented on the incident and has yet to respond to CryptoSlate’s request for comment as of press time.

The $26 Million Anomaly

The chaos began not with a headline, but with a spread.

Vida revealed that he operated a complex funding rate arbitrage book in which his algorithm held a $500,000 short position in BROCCOLI714 perpetual futures on Binance to hedge a corresponding long position in the spot market.

This strategy typically yields steady, low-risk returns by harvesting the funding fees paid by leverage-seeking speculators.

However, the model broke at 4 AM on New Year’s Day.

“My short-term surge alert program and spot-futures spread alert program went off like crazy,” Vida said. “I rushed to my computer. My gut reaction was to close the arbitrage position immediately.”

The market displayed signs of severe dislocation. Vida’s original $500,000 hedge had ballooned into a chaotic imbalance: the spot position swelled to $800,000 while the futures leg lagged significantly. Closing the position instantly would have locked in a $300,000 profit.

Yet, Vida hesitated because the price action felt wrong. He noted:

“Historically, no whale ignores the spread and violently pumps spot like that.”

A quick scan of the order book revealed the source of the distortion. On the Binance spot market, a single entity had placed buy orders worth nearly $26 million within 10% of the current price. In contrast, the futures market showed a shallow depth of only $50,000.

For a token with a circulating market capitalization of just $40 million, a $26 million bid wall represents a statistical impossibility for a rational actor.

Institutional investors or other sophisticated traders do not execute entries by flashing their entire bankroll on the bid side. They act quietly, using time-weighted average price (TWAP) algorithms to mask their intent.

Vida stated:

“I figured it had to be a hacked account or a bug in a market-making program. No whale is dumb enough to do charity like that. No whale plays the spot market like this.”

Gaming the circuit breaker

Vida revealed that he realized the implication of the situation immediately as it meant the “attacker” intended to pump the spot price to lift the value of their holdings before exiting.

So, as long as the $26 million buy wall remained, the price of BROCCOLI714 had only one direction to go.

As a result, the trader pivoted from a neutral arbitrage strategy to a directional long position.

However, the sheer velocity of the spot price surge triggered Binance’s automated circuit breakers. These volatility protection mechanisms freeze the upper limits of contract prices to prevent liquidation cascades during flash crashes or pumps.

While the spot price tore through the $0.07 mark, Binance’s futures engine capped contracts at $0.038. This created a massive, artificial disparity between the two markets.

Other traders watching the Bybit exchange saw contracts trading freely at $0.055, confirming that the suppression remained local to Binance’s risk engine.

As a result, Vida deployed a high-frequency sniping strategy that allowed him to hammer the execution terminal, attempting to open long positions every 5 to 10 seconds.

He added that he bet that the circuit breaker would momentarily lift as the spot price stabilized at higher plateaus.

He explained:

“As soon as the order succeeded, it meant the circuit breaker mechanism’s time had passed. I successfully waited for this opportunity.”

This strategy worked as Vida managed to pile $200,000 into long positions at an entry cost of roughly $0.046. He now rode the coattails of the mysterious $26 million bidder, effectively front-running the inevitable correction.

The vanishing bid

The resulting trade now hinged on a game of chicken with Binance’s risk control department.

Market participants know that exchanges monitor for anomalous flows. A $26 million bid on an illiquid coin triggers internal red flags. If Binance flagged the account as compromised or the result of a malfunctioning algorithm, they would freeze the funds and pull the orders.

Vida watched the order book on a dedicated monitor. At one point, the massive buy wall flickered and vanished, only to reappear a minute later, driving the price to $0.15. This erratic behavior showed that the end of the trade had neared.

Vida pointed out:

“I knew the final outcome would definitely be a total loss. Once the account is risk-controlled and bids withdrawn, Broccoli crashes.”

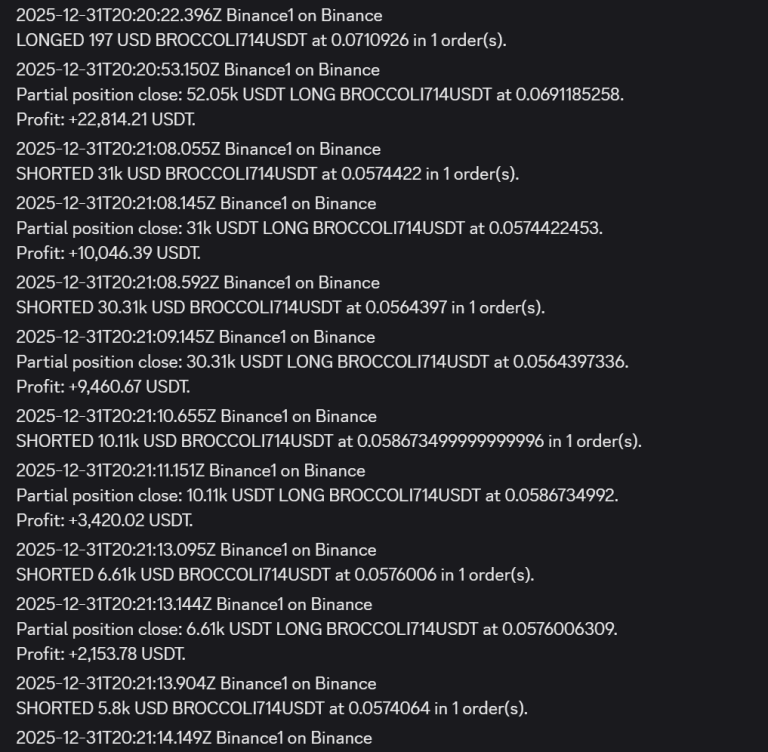

At 4:20 AM, Vida executed a complete exit. He sold the original holdings, the arbitrage hedge, and the newly acquired speculative longs. This frantic selling spree liquidated roughly $1.5 million from the market, securing a massive profit from the initial capital of roughly $400,000.

Ten minutes later, the prophecy fulfilled itself. At 4:31 AM, the $26 million buy wall vanished permanently. The support evaporated.

Sensing the shift, Vida flipped short and opened a $400,000 short position at $0.065.

Without the artificial buying pressure, gravity took hold. The token plummeted, eventually finding a floor near $0.02. The trader covered the short, capturing the entire lifecycle of the pump-and-dump.

Binance says no hack evidence yet as questions linger

The aftermath leaves the market with more questions than answers. In the high-stakes world of digital assets, money rarely vanishes without a trace, yet this event bears the hallmarks of a chaotic transfer of wealth from one entity to the opportunistic few.

However, Vida claimed that Binance had reportedly said that an initial internal investigation found “no clear signs” of a platform breach.

According to him, the exchange said:

“From the review of existing internal data, no clear signs of hacking attacks have been found so far. The platform has not received any related feedback regarding stolen accounts through customer service or large client communication channels.”

This denial eliminates the most convenient narrative, a hack, and leaves a more perplexing one: incompetence. If no theft occurred, then a market maker or a high-net-worth individual deliberately or accidentally burned tens of millions of dollars to pump a meme coin.

The denial also raises broader questions about how exchange circuit breakers, internal risk controls, and cross-market spreads behave when liquidity and automation collide in obscure corners of the market.

As of press time, BROCCOLI714 trades at pre-pump levels. The $26 million wall remains gone, but for those who woke up at 4 AM, the year 2026 has already delivered its most profitable surprise.

The post Controversial trader exploits a New Year glitch on Binance to make $1.5 million in under 24 hours appeared first on CryptoSlate.